Construction Holdback Journal Entry . Web when progress billing a job, revenue for the entire completed work should be recognized at the time of. Chances are, you know what holdback is but do you. Web the new revenue standard will replace the construction contract guidance and substantially all existing revenue recognition guidance under ifrs and. Web if you are a construction company that is seeking assistance in preparing financial statements, filing corporate income taxes, and advice. When abc complete the construction, they have to record revenue. Web to account for a holdback (retainage) in sage simply accounting: Web please prepare journal entry for holdback receivable. Web do you work or own a company in the construction industry? So much so, that most owners don’t pay contractors in full until a. Web accountability is huge in construction. Create a holdback receivable asset account (if you have.

from www.chegg.com

Chances are, you know what holdback is but do you. Create a holdback receivable asset account (if you have. So much so, that most owners don’t pay contractors in full until a. When abc complete the construction, they have to record revenue. Web do you work or own a company in the construction industry? Web to account for a holdback (retainage) in sage simply accounting: Web when progress billing a job, revenue for the entire completed work should be recognized at the time of. Web accountability is huge in construction. Web if you are a construction company that is seeking assistance in preparing financial statements, filing corporate income taxes, and advice. Web please prepare journal entry for holdback receivable.

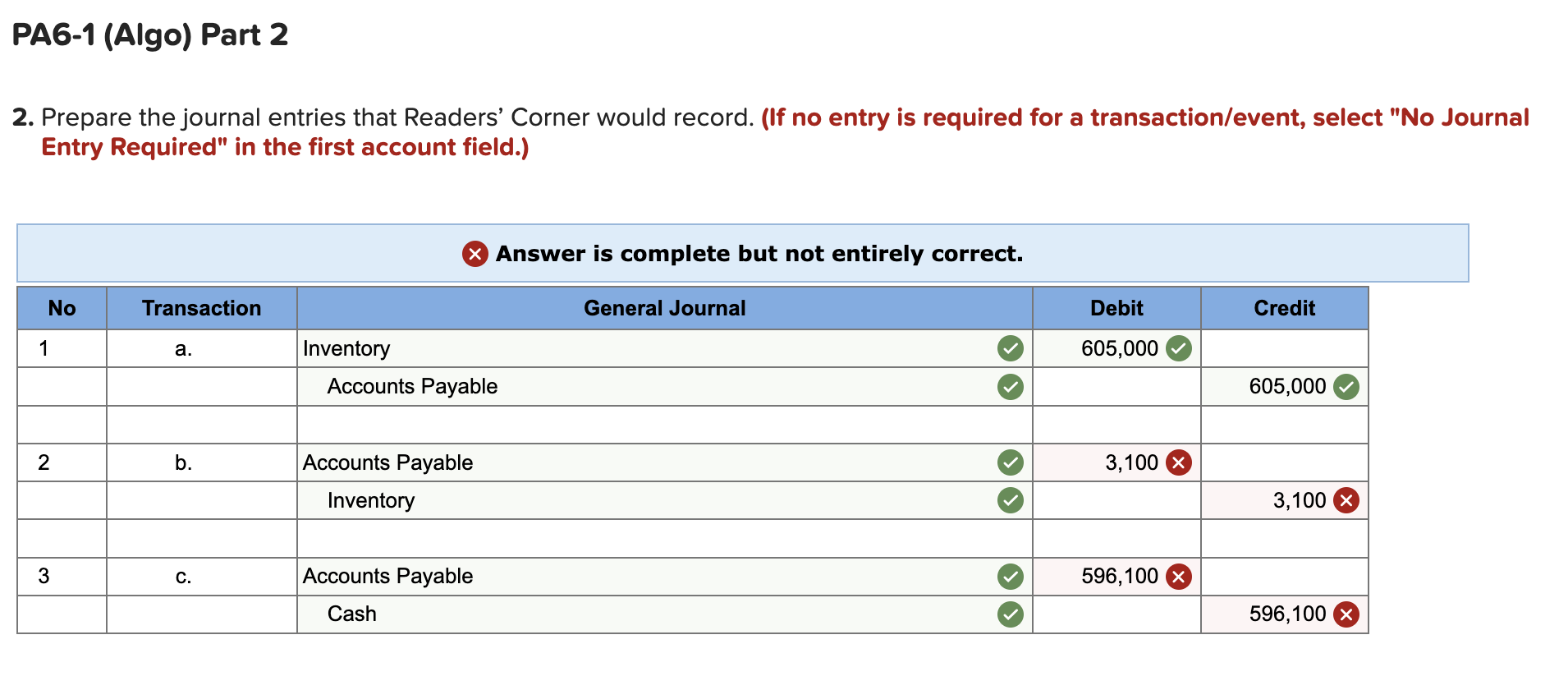

Solved The transactions listed below are typical of those

Construction Holdback Journal Entry Create a holdback receivable asset account (if you have. Create a holdback receivable asset account (if you have. Web please prepare journal entry for holdback receivable. So much so, that most owners don’t pay contractors in full until a. Web if you are a construction company that is seeking assistance in preparing financial statements, filing corporate income taxes, and advice. Web to account for a holdback (retainage) in sage simply accounting: Web accountability is huge in construction. Web the new revenue standard will replace the construction contract guidance and substantially all existing revenue recognition guidance under ifrs and. Chances are, you know what holdback is but do you. When abc complete the construction, they have to record revenue. Web do you work or own a company in the construction industry? Web when progress billing a job, revenue for the entire completed work should be recognized at the time of.

From www.vrogue.co

Adjusting Entries Definition Types Examples vrogue.co Construction Holdback Journal Entry Web do you work or own a company in the construction industry? Create a holdback receivable asset account (if you have. So much so, that most owners don’t pay contractors in full until a. Web if you are a construction company that is seeking assistance in preparing financial statements, filing corporate income taxes, and advice. When abc complete the construction,. Construction Holdback Journal Entry.

From z1erp.com

Journal Entry Template Construction Holdback Journal Entry Chances are, you know what holdback is but do you. Web if you are a construction company that is seeking assistance in preparing financial statements, filing corporate income taxes, and advice. Create a holdback receivable asset account (if you have. Web when progress billing a job, revenue for the entire completed work should be recognized at the time of. So. Construction Holdback Journal Entry.

From www.scribd.com

Journal Entry 2 PDF Construction Holdback Journal Entry Web to account for a holdback (retainage) in sage simply accounting: Web when progress billing a job, revenue for the entire completed work should be recognized at the time of. Web the new revenue standard will replace the construction contract guidance and substantially all existing revenue recognition guidance under ifrs and. Web if you are a construction company that is. Construction Holdback Journal Entry.

From quickbooks.intuit.com

Solved Work in Progress General Contractor Construction Construction Holdback Journal Entry Web when progress billing a job, revenue for the entire completed work should be recognized at the time of. Web please prepare journal entry for holdback receivable. Web do you work or own a company in the construction industry? Web to account for a holdback (retainage) in sage simply accounting: Web the new revenue standard will replace the construction contract. Construction Holdback Journal Entry.

From solevant.com

Understanding the Basics What Is a Journal Entry in Accounting? Construction Holdback Journal Entry Web if you are a construction company that is seeking assistance in preparing financial statements, filing corporate income taxes, and advice. Chances are, you know what holdback is but do you. Web do you work or own a company in the construction industry? Web please prepare journal entry for holdback receivable. So much so, that most owners don’t pay contractors. Construction Holdback Journal Entry.

From www.thks.com.my

How to record construction in progress journal entry? Jan 12, 2021 Construction Holdback Journal Entry Web if you are a construction company that is seeking assistance in preparing financial statements, filing corporate income taxes, and advice. Web when progress billing a job, revenue for the entire completed work should be recognized at the time of. Web to account for a holdback (retainage) in sage simply accounting: So much so, that most owners don’t pay contractors. Construction Holdback Journal Entry.

From rmc.link

Session_2.utf8.md Construction Holdback Journal Entry Web when progress billing a job, revenue for the entire completed work should be recognized at the time of. Web accountability is huge in construction. Chances are, you know what holdback is but do you. Web do you work or own a company in the construction industry? Web if you are a construction company that is seeking assistance in preparing. Construction Holdback Journal Entry.

From db-excel.com

Construction Work In Progress Spreadsheet in The Field Guide To Construction Holdback Journal Entry Create a holdback receivable asset account (if you have. Web accountability is huge in construction. Web please prepare journal entry for holdback receivable. When abc complete the construction, they have to record revenue. Web when progress billing a job, revenue for the entire completed work should be recognized at the time of. Web do you work or own a company. Construction Holdback Journal Entry.

From www.accountancyknowledge.com

Journal Entry Problems and Solutions Format Examples Construction Holdback Journal Entry Chances are, you know what holdback is but do you. Web the new revenue standard will replace the construction contract guidance and substantially all existing revenue recognition guidance under ifrs and. Web please prepare journal entry for holdback receivable. Web when progress billing a job, revenue for the entire completed work should be recognized at the time of. Web to. Construction Holdback Journal Entry.

From www.scribd.com

Journal Entry PDF Construction Holdback Journal Entry Web if you are a construction company that is seeking assistance in preparing financial statements, filing corporate income taxes, and advice. Chances are, you know what holdback is but do you. Web the new revenue standard will replace the construction contract guidance and substantially all existing revenue recognition guidance under ifrs and. Web please prepare journal entry for holdback receivable.. Construction Holdback Journal Entry.

From jessicatemckee.blogspot.com

JessicateMckee Construction Holdback Journal Entry Web the new revenue standard will replace the construction contract guidance and substantially all existing revenue recognition guidance under ifrs and. So much so, that most owners don’t pay contractors in full until a. Web to account for a holdback (retainage) in sage simply accounting: Web accountability is huge in construction. Web if you are a construction company that is. Construction Holdback Journal Entry.

From www.chegg.com

Solved The transactions listed below are typical of those Construction Holdback Journal Entry Create a holdback receivable asset account (if you have. So much so, that most owners don’t pay contractors in full until a. Web when progress billing a job, revenue for the entire completed work should be recognized at the time of. Web do you work or own a company in the construction industry? Web accountability is huge in construction. Web. Construction Holdback Journal Entry.

From rvsbellanalytics.com

Journal entries for lease accounting Construction Holdback Journal Entry Web if you are a construction company that is seeking assistance in preparing financial statements, filing corporate income taxes, and advice. Chances are, you know what holdback is but do you. Web accountability is huge in construction. When abc complete the construction, they have to record revenue. Create a holdback receivable asset account (if you have. Web when progress billing. Construction Holdback Journal Entry.

From www.chegg.com

Solved During 2024 , its first year of operations, Hollis Construction Holdback Journal Entry Web please prepare journal entry for holdback receivable. Web do you work or own a company in the construction industry? Web the new revenue standard will replace the construction contract guidance and substantially all existing revenue recognition guidance under ifrs and. Chances are, you know what holdback is but do you. Web if you are a construction company that is. Construction Holdback Journal Entry.

From www.chegg.com

Solved FinanceCo lent 9.8 million to Corbin Construction on Construction Holdback Journal Entry Web to account for a holdback (retainage) in sage simply accounting: Web when progress billing a job, revenue for the entire completed work should be recognized at the time of. Web accountability is huge in construction. Web the new revenue standard will replace the construction contract guidance and substantially all existing revenue recognition guidance under ifrs and. So much so,. Construction Holdback Journal Entry.

From www.chegg.com

Solved On February 1, 2024, Arrow Construction Company Construction Holdback Journal Entry Web the new revenue standard will replace the construction contract guidance and substantially all existing revenue recognition guidance under ifrs and. Web please prepare journal entry for holdback receivable. Chances are, you know what holdback is but do you. Web accountability is huge in construction. Web when progress billing a job, revenue for the entire completed work should be recognized. Construction Holdback Journal Entry.

From www.cloudby.co

Cloudby General Ledger Solution Construction Holdback Journal Entry Chances are, you know what holdback is but do you. Web the new revenue standard will replace the construction contract guidance and substantially all existing revenue recognition guidance under ifrs and. Web when progress billing a job, revenue for the entire completed work should be recognized at the time of. Web accountability is huge in construction. So much so, that. Construction Holdback Journal Entry.

From www.cradleaccounting.com

How to Calculate the Journal Entries for an Operating Lease under ASC 842 Construction Holdback Journal Entry Web accountability is huge in construction. So much so, that most owners don’t pay contractors in full until a. Create a holdback receivable asset account (if you have. Web the new revenue standard will replace the construction contract guidance and substantially all existing revenue recognition guidance under ifrs and. Web when progress billing a job, revenue for the entire completed. Construction Holdback Journal Entry.